Embark on an accounting adventure with ACC 201 Module 3 Problem Set, your ultimate companion for navigating the intricacies of accounting principles and practices. Dive into real-world scenarios, sharpen your problem-solving skills, and gain a deeper understanding of the language of business.

From fundamental concepts to advanced techniques, this module will equip you with the knowledge and tools to tackle accounting challenges head-on. Prepare to elevate your accounting prowess and unlock the secrets of financial reporting.

Key Concepts

ACC 201 Module 3 Problem Set delves into the intricacies of financial accounting, providing a solid foundation for understanding the principles and practices that govern the preparation of financial statements.

This module encompasses a comprehensive exploration of the accounting cycle, from the initial recording of transactions to the preparation of financial statements. It covers fundamental accounting concepts, such as the double-entry system, debits and credits, and the matching principle.

Types of Transactions

The module examines various types of transactions that businesses encounter, including cash transactions, credit transactions, and non-cash transactions. Students will learn how to analyze and record these transactions accurately, considering their impact on the accounting equation (Assets = Liabilities + Equity).

Impact on Financial Statements

The module emphasizes the significance of understanding how transactions affect financial statements. Students will explore the relationships between the income statement, balance sheet, and statement of cash flows. They will learn how to use these statements to assess a company’s financial performance and position.

Problem-Solving Techniques

In ACC 201 Module 3 Problem Set, effective problem-solving techniques are crucial for success. This involves a structured approach that emphasizes critical thinking, analytical skills, and a systematic process to resolve accounting problems accurately and efficiently.

To approach accounting problems effectively, follow these steps:

- Read and understand the problem statement carefully:Identify the key information and requirements of the problem.

- Analyze the problem:Break down the problem into smaller, manageable parts. Determine the relevant accounting principles and concepts applicable to the situation.

- Formulate a solution:Develop a logical and systematic approach to solve the problem, considering all relevant factors.

- Solve the problem:Apply the appropriate accounting techniques and calculations to find the solution.

- Check your solution:Verify the accuracy of your solution by reviewing your work and ensuring it aligns with the problem statement and accounting principles.

To enhance problem-solving skills, consider these tips:

- Practice regularly to develop proficiency in applying accounting concepts and techniques.

- Seek clarification when needed, consult with instructors or peers to gain a better understanding of the problem.

- Identify common accounting errors and learn from mistakes to improve accuracy.

- Stay updated with accounting standards and regulations to ensure your problem-solving approach is aligned with current practices.

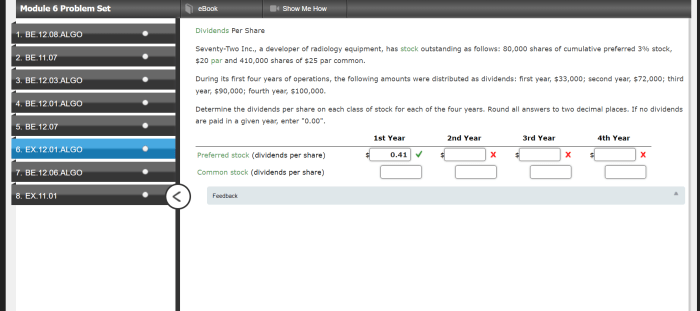

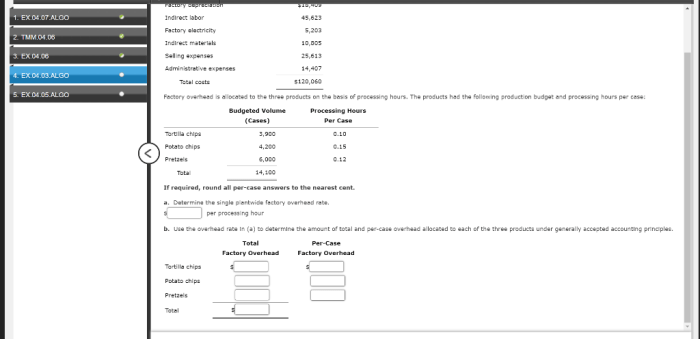

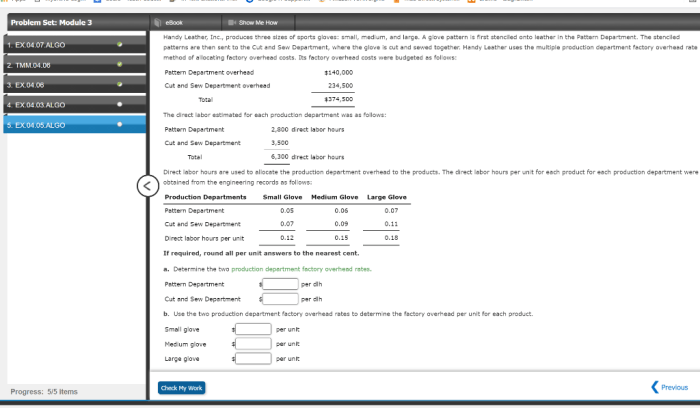

Case Studies and Examples: Acc 201 Module 3 Problem Set

Accounting principles are not just theoretical concepts; they have real-world applications that impact businesses and individuals. Case studies and examples help us understand how these principles are used in practice and the consequences of accounting decisions.

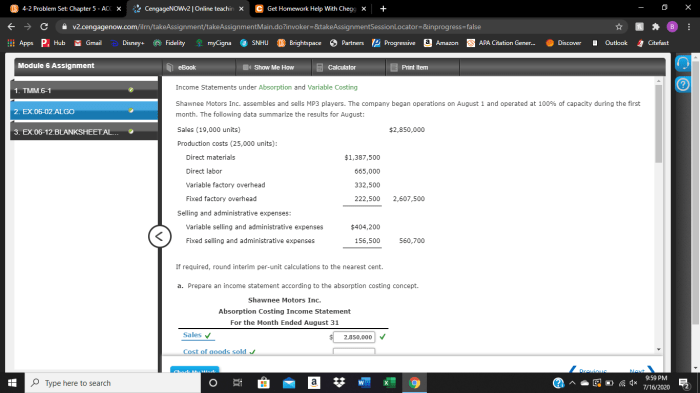

Financial Statement Analysis

Financial statements provide a snapshot of a company’s financial health. By analyzing these statements, investors, creditors, and other stakeholders can assess the company’s performance, liquidity, and solvency.

- Income Statement:Shows a company’s revenues, expenses, and net income over a period.

- Balance Sheet:Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement:Reports the cash inflows and outflows of a company over a period.

Transaction Analysis

Every business transaction has accounting implications. By analyzing transactions, accountants can ensure that they are recorded accurately and consistently.

- Revenue Recognition:Determining when revenue should be recognized can be complex, especially in cases of long-term contracts or installment sales.

- Expense Recognition:Matching expenses to the periods in which they are incurred is crucial for accurate financial reporting.

- Asset Valuation:Assets must be valued appropriately to ensure that financial statements reflect their true worth.

Hypothetical Scenarios

Hypothetical scenarios can test our understanding of accounting principles and help us develop critical thinking skills.

- Scenario 1:A company purchases equipment on credit. How will this transaction affect the company’s financial statements?

- Scenario 2:A company issues new shares of stock. What are the accounting implications of this transaction?

- Scenario 3:A company experiences a loss on the sale of an investment. How should this loss be reported on the income statement?

Excel and Technology Tools

Excel and other technology tools have revolutionized the way accounting professionals solve problems and manage financial data. These tools offer powerful capabilities that can automate calculations, enhance data analysis, and improve overall efficiency.

Using Excel Functions and Formulas

Excel functions and formulas are essential for automating calculations and manipulating data in accounting. Functions like SUM, AVERAGE, and COUNTIF can quickly perform complex calculations on large datasets. Formulas allow you to create dynamic relationships between cells, so that changes in one cell automatically update calculations in other cells.

ACC 201 Module 3 Problem Set can be quite challenging, especially if you’re not familiar with the material. However, if you’re looking for some extra practice, I recommend checking out the unit 5 apush saq prompts . These prompts are a great way to test your understanding of the key concepts in the module.

Once you’ve reviewed the prompts, be sure to come back to the ACC 201 Module 3 Problem Set and see how much your understanding has improved.

Example: A formula like “=SUM(A1:A10)” would add up the values in cells A1 through A10.

Benefits of Technology in Accounting

- Automation:Technology tools automate repetitive tasks, freeing up accountants for more complex and value-added activities.

- Accuracy:Formulas and automated calculations minimize errors and ensure consistency in financial reporting.

- Data Analysis:Technology tools provide powerful data analysis capabilities, allowing accountants to identify trends, patterns, and insights from financial data.

- Collaboration:Cloud-based accounting software enables multiple users to collaborate on financial data in real-time.

Limitations of Technology in Accounting

- Cost:Implementing and maintaining technology tools can be expensive.

- Learning Curve:Learning new software and technology tools can require significant training and time.

- Reliance:Over-reliance on technology can lead to decreased manual skills and potential data security risks.

Common Errors and Pitfalls

Navigating ACC 201 Module 3 Problem Set can be a rewarding yet challenging experience. To ensure accuracy and success, it’s crucial to be aware of common errors and pitfalls that students often encounter.

Understanding Problem Requirements

- Failing to carefully read and comprehend the problem requirements can lead to incorrect or incomplete solutions. Take time to identify key information and determine what the problem is asking you to solve.

- Assuming that all the information provided is relevant. Critically evaluate the data given and identify which pieces are essential for solving the problem.

Applying Accounting Concepts

- Incorrectly applying accounting principles and standards. Ensure a solid understanding of the relevant accounting concepts and their proper application.

- Failing to consider the impact of transactions on multiple accounts. Remember that accounting transactions affect multiple accounts simultaneously.

Performing Calculations, Acc 201 module 3 problem set

- Making mathematical errors. Double-check your calculations and use a calculator to minimize errors.

- Rounding errors. Be consistent in applying rounding rules and avoid introducing unnecessary errors.

Preparing Financial Statements

- Omitting or misclassifying accounts. Ensure that all relevant accounts are included and correctly classified in the financial statements.

- Failing to balance the financial statements. Verify that the Trial Balance is balanced before preparing the financial statements.

Best Practices for Reviewing and Checking Work

To enhance accuracy, adopt these best practices:

- Take breaks and come back to your work with a fresh perspective.

- Review your solutions against the problem requirements to ensure completeness.

- Use a checklist to verify that all necessary steps have been taken.

- Seek feedback from classmates, instructors, or tutors to identify areas for improvement.

FAQs

What are the key concepts covered in ACC 201 Module 3?

ACC 201 Module 3 delves into the fundamental principles of accounting, including the accounting equation, double-entry bookkeeping, and the preparation of financial statements.

How can I improve my problem-solving skills for accounting?

Practice regularly, break down problems into smaller steps, and seek guidance from your instructor or peers. Utilize Excel and other technology tools to enhance your efficiency.

What are some common errors to avoid in ACC 201 Module 3?

Pay attention to debits and credits, ensure accuracy in calculations, and avoid mixing up different accounting periods. Regularly review your work and seek feedback to minimize errors.