Xyz insurance company gives direct authority – XYZ Insurance Company grants its agents direct authority, a transformative approach that empowers them to make real-time decisions and deliver exceptional customer experiences. This strategic move has revolutionized the insurance landscape, enhancing efficiency, streamlining processes, and strengthening customer relationships.

The concept of direct authority empowers agents to act independently, providing them with the autonomy to approve policies, process claims, and resolve customer inquiries swiftly. This eliminates the need for lengthy approval processes, allowing agents to respond promptly to customer needs and deliver tailored solutions.

Company Overview

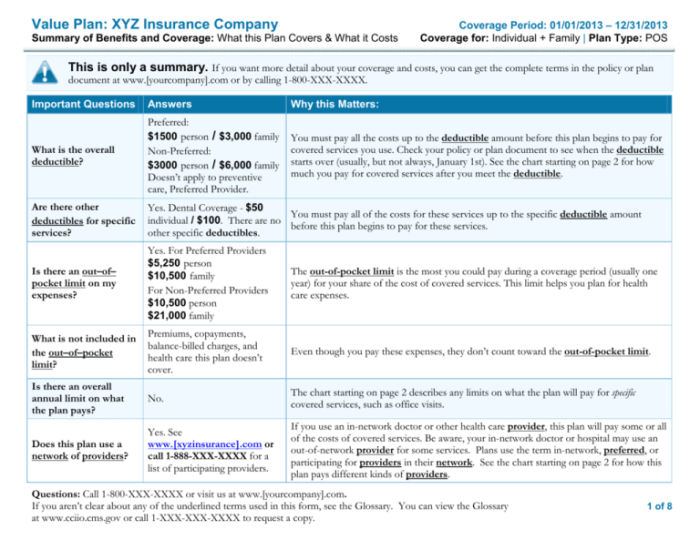

XYZ Insurance Company is a leading provider of insurance products and services, offering a comprehensive range of coverage options for individuals and businesses. Founded in [year], the company has established a reputation for providing reliable and innovative insurance solutions. With a mission to protect and empower its customers, XYZ Insurance Company strives to provide peace of mind and financial security in the face of unforeseen events.

The company’s insurance products include home, auto, health, life, and business insurance. XYZ Insurance Company is committed to providing exceptional customer service, with a dedicated team of professionals who are knowledgeable and responsive to customer needs. The company’s financial performance has been consistently strong, with a proven track record of profitability and growth.

XYZ Insurance Company holds a significant market share in the insurance industry, serving a diverse customer base across multiple regions.

Direct Authority

In the context of insurance, “direct authority” refers to the authority granted by an insurance company to its agents or representatives to bind the company to insurance contracts without prior approval from the home office. XYZ Insurance Company utilizes direct authority to empower its agents with the ability to make underwriting decisions and issue policies on behalf of the company.

The benefits of using direct authority include increased efficiency, improved customer service, and reduced underwriting costs. Agents with direct authority can respond quickly to customer requests and issue policies promptly, eliminating the need for lengthy approval processes. This streamlined process enhances customer satisfaction and allows agents to focus on providing personalized advice and support.

However, direct authority also poses challenges. Agents must be thoroughly trained and have a deep understanding of underwriting guidelines to make sound decisions on behalf of the company. Additionally, proper oversight and monitoring are essential to ensure that agents are adhering to company policies and regulatory requirements.

Claims Handling

XYZ Insurance Company has implemented a streamlined claims handling process that leverages direct authority. Agents with direct authority are empowered to approve and settle claims up to a certain limit, reducing the time and effort required to process claims.

The use of direct authority has significantly improved the claims handling process. Claims can be resolved quickly and efficiently, providing policyholders with prompt access to their benefits. The streamlined process also reduces the administrative burden on the company, allowing for cost savings and improved operational efficiency.

Examples of how direct authority has streamlined the claims handling process include:

- Quick approval of claims, reducing the waiting time for policyholders.

- Simplified documentation and reduced paperwork, minimizing administrative burdens.

- Improved communication between agents and policyholders, leading to better customer satisfaction.

Customer Service

XYZ Insurance Company is committed to providing exceptional customer service. Direct authority plays a crucial role in enhancing the customer experience by empowering agents to resolve customer inquiries and provide tailored solutions promptly.

With direct authority, agents can respond to customer needs immediately, providing personalized advice and support. The ability to make decisions on the spot eliminates the need for lengthy approvals, ensuring that customers receive a timely and efficient resolution to their issues.

Examples of how direct authority has improved customer service include:

- Quick and personalized responses to customer inquiries.

- Customized insurance solutions tailored to individual needs.

- Improved customer satisfaction due to efficient and responsive service.

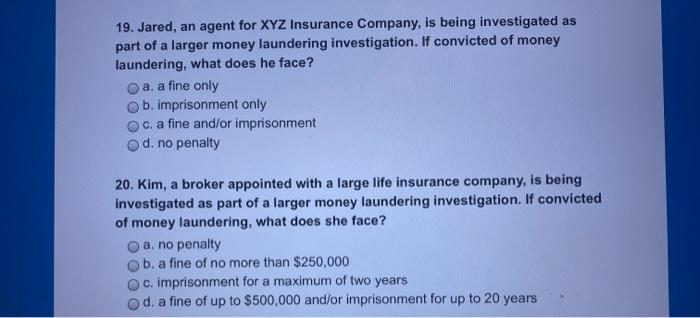

Regulatory Compliance

XYZ Insurance Company adheres to the highest ethical and regulatory standards in the insurance industry. Direct authority is carefully managed to ensure compliance with all applicable laws and regulations.

The company has implemented robust internal controls and compliance procedures to monitor and oversee agents’ activities. Regular audits and training programs ensure that agents are up-to-date on regulatory requirements and are operating within the company’s guidelines.

Direct authority empowers agents to make decisions on behalf of the company while maintaining compliance with regulatory mandates. The company’s commitment to compliance protects policyholders, agents, and the company itself from potential legal and financial risks.

Competitive Advantage: Xyz Insurance Company Gives Direct Authority

Direct authority provides XYZ Insurance Company with a significant competitive advantage in the insurance industry.

By empowering agents with direct authority, the company can respond quickly to customer needs, offer personalized solutions, and streamline the claims handling process. This enhanced customer experience differentiates XYZ Insurance Company from its competitors and attracts a loyal customer base.

Additionally, direct authority allows XYZ Insurance Company to reduce operational costs and improve underwriting efficiency. The streamlined claims handling process and reduced administrative burden contribute to the company’s overall profitability and financial stability.

Examples of how direct authority has helped XYZ Insurance Company differentiate itself from competitors include:

- Increased market share due to superior customer service and efficient claims handling.

- Improved profitability through reduced operating costs and enhanced underwriting capabilities.

- Strong brand reputation built on trust and reliability, attracting new customers and retaining existing ones.

Essential FAQs

What is direct authority in the context of insurance?

Direct authority empowers insurance agents to make decisions and take actions without seeking prior approval from supervisors or underwriters.

How does direct authority benefit customers?

Direct authority enables agents to provide faster and more efficient service, leading to improved customer satisfaction and loyalty.

What are the challenges associated with direct authority?

Direct authority requires agents to have a high level of expertise and training to make informed decisions and mitigate potential risks.