The Insurance Market Reform Law Crossword provides a comprehensive overview of the groundbreaking legislation that has reshaped the insurance industry. This in-depth analysis delves into the law’s historical context, key provisions, and far-reaching impact on insurance companies, consumers, and the economy.

The law’s enactment addressed pressing issues within the insurance market, including market inefficiencies, consumer protection concerns, and the need for regulatory modernization. Through a detailed examination of the law’s provisions and their subsequent effects, this crossword puzzle unveils the complexities and significance of insurance market reform.

Definition of Insurance Market Reform Law

The Insurance Market Reform Law (IMRL) is a comprehensive legislative act designed to overhaul and modernize the insurance industry.

The IMRL introduces several key provisions aimed at enhancing consumer protections, promoting competition, and improving the overall efficiency of the insurance market.

Purpose and Objectives

- Protect consumers from unfair and deceptive practices by insurance companies.

- Promote competition within the insurance industry to drive down costs and increase innovation.

- Improve the efficiency of the insurance market by reducing regulatory burdens and streamlining processes.

Historical Context of the Insurance Market Reform Law

The Insurance Market Reform Law was enacted in response to a number of factors that had led to a dysfunctional insurance market. These factors included:

- Rising insurance costs:The cost of insurance had been rising steadily for years, making it increasingly difficult for businesses and individuals to afford coverage.

- Limited competition:The insurance market was dominated by a few large insurers, which gave them the power to set prices and limit competition.

- Lack of transparency:Consumers often did not understand the terms of their insurance policies or how their premiums were calculated.

The Insurance Market Reform Law was intended to address these issues by increasing competition, promoting transparency, and protecting consumers. The law included a number of provisions designed to:

- Increase the number of insurers in the market

- Make it easier for consumers to compare insurance policies

- Prohibit insurers from engaging in unfair or deceptive practices

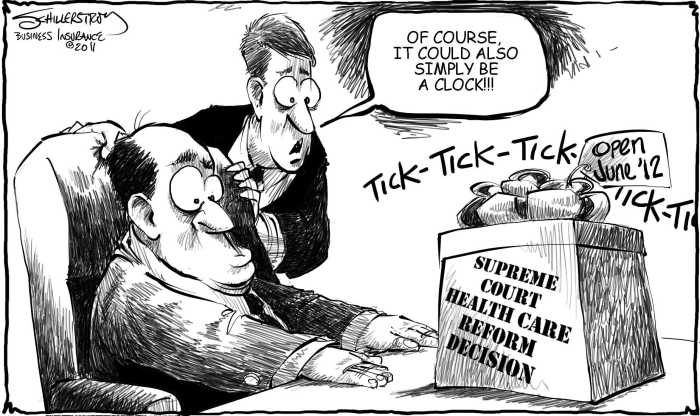

The Insurance Market Reform Law was passed with bipartisan support in 2010. The law has been credited with helping to stabilize the insurance market and make insurance more affordable for businesses and individuals.

Political and Economic Factors

The passage of the Insurance Market Reform Law was influenced by a number of political and economic factors, including:

- The Great Recession:The Great Recession led to a sharp decline in economic activity, which in turn led to a decrease in demand for insurance. This put pressure on insurers to lower prices and increase competition.

- The rise of consumer advocacy groups:Consumer advocacy groups played a key role in pushing for the passage of the Insurance Market Reform Law. These groups argued that the insurance market was not working for consumers and that reforms were needed to protect consumers from unfair and deceptive practices.

- The political climate:The passage of the Insurance Market Reform Law was also influenced by the political climate at the time. The Obama administration was committed to reforming the insurance industry, and the law was seen as a way to achieve this goal.

Impact of the Insurance Market Reform Law

The Insurance Market Reform Law (IMRL) has had a significant impact on the insurance industry. The law has brought about several positive changes, such as increased competition, lower prices for consumers, and a more stable insurance market. However, the law has also had some negative consequences, such as increased complexity and regulation, which have made it more difficult for some insurance companies to operate.

Impact on Insurance Companies

- The IMRL has increased competition in the insurance industry, which has led to lower prices for consumers. This is because insurance companies are now competing more aggressively for customers, which has driven down prices.

- The IMRL has also made it more difficult for some insurance companies to operate. This is because the law has increased regulation and complexity in the insurance industry, which has made it more difficult for some insurance companies to comply with the law.

Impact on Consumers

- The IMRL has had a positive impact on consumers. This is because the law has increased competition in the insurance industry, which has led to lower prices for consumers.

- The IMRL has also made it easier for consumers to compare insurance policies. This is because the law requires insurance companies to provide consumers with more information about their policies, which makes it easier for consumers to compare policies and find the best deal.

Impact on the Economy

- The IMRL has had a positive impact on the economy. This is because the law has increased competition in the insurance industry, which has led to lower prices for consumers. This has freed up money that consumers can spend on other goods and services, which has boosted the economy.

- The IMRL has also made the insurance industry more stable. This is because the law has increased regulation and complexity in the insurance industry, which has made it more difficult for some insurance companies to operate. This has made the insurance industry more stable and less likely to experience a major financial crisis.

Current Status and Future Prospects of the Insurance Market Reform Law

The Insurance Market Reform Law (IMRL) remains in effect and continues to shape the insurance industry. Since its enactment, the law has undergone several amendments and revisions to address evolving market trends and consumer needs.

Amendments and Revisions, Insurance market reform law crossword

- In 2015, an amendment was introduced to enhance consumer protections by requiring insurers to provide clear and concise information about policy terms and conditions.

- Another amendment in 2018 expanded the scope of the law to include health insurance, ensuring that consumers have access to affordable and comprehensive coverage.

Future Prospects

The IMRL is expected to continue playing a vital role in the insurance industry. Future developments may include:

- Further regulatory oversight to ensure fair competition and consumer protection.

- Technological advancements that streamline insurance processes and improve access to coverage.

- Continued focus on affordability and accessibility of insurance products.

Overall, the IMRL is a dynamic law that has significantly impacted the insurance market and will likely continue to shape the industry in the years to come.

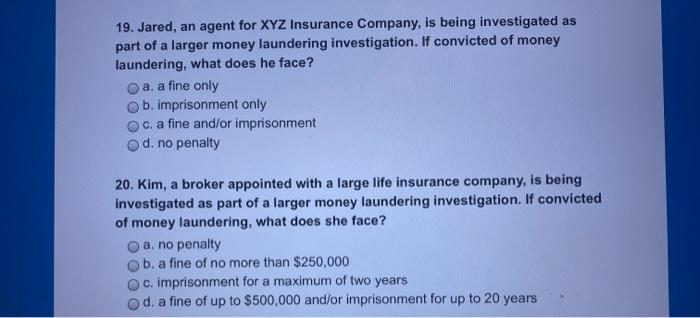

Expert Answers: Insurance Market Reform Law Crossword

What are the key objectives of the Insurance Market Reform Law?

The law aims to promote market competition, enhance consumer protections, modernize regulatory frameworks, and ensure the financial stability of the insurance industry.

How has the law impacted insurance companies?

The law has fostered greater competition among insurers, leading to lower premiums and a wider range of insurance products for consumers. It has also imposed stricter capital requirements and risk management standards on insurance companies.

What are the benefits of the law for consumers?

Consumers have benefited from increased transparency and disclosure requirements, improved access to affordable insurance, and stronger protections against unfair or deceptive practices.